does nh have food tax

The elimination of the tax would. Does New Hampshire have sales tax.

Biden S Federal Gas Tax Holiday Would It Help Or Hurt Nh Merrimack Nh Patch

New Hampshire doesnt have an income tax.

. This means that New Hampshire has amongst the. The New Hampshire Senate recently passed a bill SB 404 which would phase out the state tax on interest and dividends over the next five years. Does nh tax food.

Unlike most states New Hampshire does not have a dependent. The tax rate will get lower each year until it goes away. The sales tax rate in New York state is 4 and New York City has additional tax rates which when combined with the state tax rate makes the rate closer to 9.

Is New Hampshire a good tax state. However currently theres a 5 tax on dividends and interest in excess of 2400 for individuals 4800. While new hampshire lacks a sales tax and personal income tax it does have some of the.

This ideal is taken seriously by every resident and extends to tax laws as well as other local and state rules. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. New Hampshire is actually in the process of phasing out the interest and dividends tax.

New Hampshires general sales tax of NA does not apply to the purchase of beer. Is New Hampshire the only state without sales tax. A 9 tax is also assessed on motor vehicle rentals.

New Hampshire is one of the five states in the USA that have no state sales tax. The elimination of the tax. Why does NH not pay taxes.

New Hampshire has opted not to have a state sales tax. In New Hampshire beer vendors. These excises include a 9 tax on restaurants and prepared.

Income Tax Range. New Hampshire Beer Tax - 030 gallon. Prepared food is subject to special sales tax rates under new hampshire law.

Alongside the State of Alaska New Hampshire is one of two states that have neither a state income tax nor a sales tax. Is New Hampshire a good tax state. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt. The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. The tax must be separately stated and separately charged on all invoices bills displays or. Does nh tax food.

States Without Sales Tax Article

Sales Taxes In The United States Wikipedia

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Muse Thai Bistro Manchester Nh

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

New Hampshire Magazine Best Of Nh People Places And Restaurants

New Hampshire Sales Tax Rate 2022

Maine Sales Tax Small Business Guide Truic

China Gourmet Restaurant Menu In Goffstown New Hampshire Usa

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

New Hampshire Cuts Tax On Rooms Meals To 8 5 Cbs Boston

Sales Taxes In The United States Wikipedia

Do Safety Net Programs Impact Food Security In The United States Econofact

Mark Fernald Why Your Property Taxes Are So High

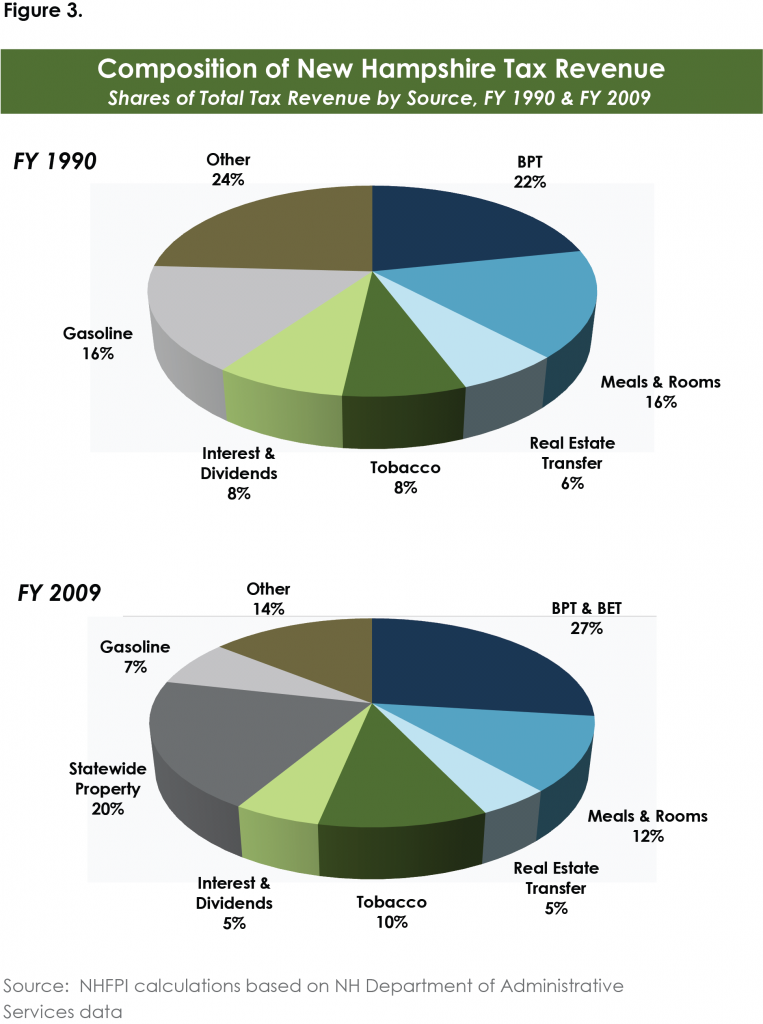

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute